U74999HR2014PTC053454 Registered Office - Plot No119 Sector - 44 Gurgaon - 122001 Haryana Tel no. Banking business 60 D.

Uk Visa Application Fees From Russia 2019 20 Uk Visa Visa Application

Incentive Up to 10 years for new companies and up to 5 years for expansion projects 100 exemption is provided from the year they start generating statutory income.

. Directors or shareholders may request an audit assurance. Risk Warning Disclaimers Fundnel Pte. KUALA LUMPUR Malaysia August 24 2022--Leading financial services company Northern Trust Nasdaq.

We can match your current branding or design something new. Investing in crowdfunding and exempt market offerings has significant risk. PrivateWhite Label Tea Designs.

Chargeable income reduced rate and exempt dividend 60 AA. British dependency and English is the official. However the non-deductibility of costs attributable to foreign-sourced income should be considered.

1 A private company shall appoint an auditor for each financial year of the company. Malaysias state-owned oil company. The company constitution may require it.

A grant provider requires an audit. Owners and directors not in public records. APPOINTMENT AUDITORS OF PRIVATE COMPANY.

We will work with you to include any information or images that you wish. 6 skinny tins per case. Labuan companies enjoy tax advantages with a tax rate of 3 on audited net profits for companies that carry out trading activities and 0 for companies that carry out non-trading activities.

Although small companies are exempt from an audit under the criteria but they may still undertake an audit for various other reasons eg. NTRS is expanding its philanthropy efforts in Malaysia aligned with its vision to create more. On behalf of the company by at least 2 directors of the company.

Failure to properly distinguish exempt from non-exempt employees sometimes referred to as misclassification can adversely affect businesses. The company has lodged its latest Annual Return and Audited Financial Statements or its latest Exempt Private Company EPC certificate. Policybazaar Insurance Brokers Private Limited CIN.

Gas and tolls Parking. On behalf of the company by a director of the company in the presence of a witness who attests the signature. Domestic private or capital expenditure The Company can claim capital allowance for capital expenditure incurred.

Tax-neutral reorganizations or mergers. 457608-K a company authorized as a Certification Authority in Malaysia under Section 8 the Digital Signature Act 1997 and the Digital Signature Regulations 1998. The more notable examples include the agriculture movie theater and railroad businesses.

If you offer company cars as a benefit make sure to inform employees how you expect them to behave when using the car and which expenses youll compensate eg. Is regulated by the MAS as a recognised market operator. Investment holding company 60 FA.

S A M P L E Employee Handbook Company Name A Guide for Our Employees Last Reviewed. Investment holding company listed on Bursa Malaysia 60 G. 220 one-time fee A fully Private Label Tea design is completely original and will be uniquely yours.

As mentioned above foreign-sourced income received in Malaysia by a resident company is exempt from tax unless the recipient carries on the business of banking insurance shipping or air transport. This is perhaps most comprehensive guide listing the costs of medical treatmentprocedures in Malaysia. If the US Company owns at least 10 of the voting stock of a company which is a resident of India and the US Company receives dividends then the income tax received by the Indian Government from the Indian company with respect to the profits from which dividends are paid shall be allowed as a credit.

Foreigners can own 100 of an exempt company. Takaful business 60 AB. 2 Notwithstanding subsection 1 the Registrar shall have the power to exempt any private company from the requirement stated in that subsection according to the conditions as determined by the Registrar.

Read more below to discover a full list of medical procedures costs published by Ministry of Health Federal Government Gazette known as Private Healthcare Facilities Services Private Hospitals Other Private Healthcare Facilities Amendment. Investors may not be able to resell quickly or at all. Malaysia Company Incorporation Services.

A Labuan trading company is a company established in Labuan Malaysia that carries on certain Labuan trading or non-trading activities. Company exempt from paying taxes even if new tax laws are imposed over the next 20 years. Chargeable income of life fund subject to tax 60 B.

The companys lender requires an audit. WSALE 045 046. Established in July 1983 as Malaysias first Islamic Bank Bank Islam has 141 branches and more than 900 self-service terminals nationwide.

Where a document is to be signed by a person on behalf of more than one company that person has to sign the document separately in each capacity. SIMPLY TEA A lower priced but still delicious option to our silk sachets. At the Tea Can Company we provide bulk tea cans at wholesale tea pricing.

FrontFundr Financial Services Inc. Some industries may have hourly employees who are exempt from overtime pay. One directorshareholder companies are acceptable.

About 53 of ECF issuers were technology-centric companies with business expansion cited as. To receive wholesale pricing for our tea cans please fill out and submit our online application. In 2021 some RM2216 million was raised by 104 issuers through as many campaigns representing a 735 y-o-y jump 2020.

As a full-fledged and pure-play Islamic bank Bank Islam provides banking and financial solutions that strictly adhere to the Shariah rules and principles and are committed to the ideals of sustainable. Any dividends distributed by the company will be exempt from tax in the hands of the shareholders. Exempt employees are not subject to the overtime pay provisions of the federal Fair Labor Standards Act FLSA.

The then Government of Malaysia tabled the first reading of the Bill to repeal GST in Parliament on 31 July 2018. FFS doing business as FrontFundr and SMV Capital Markets is registered as an exempt market dealer in BC AB SK MB ON QC NB NS. Use our branding or your own private label.

July 2010 Legal Disclaimer For Employers Only The materials in this sample handbook are intended to provide a general reference or resource only. High resolution images of your finished tea cans are available at 20 per. Fundnel SG is regulated by the Monetary Authority of Singapore MAS as the holder of a capital markets services licence for dealing in securities and as an exempt financial advisor in relation to securities and collective investment schemes in SingaporeHGX Pte.

The 6 tax will replace a sales-and-service tax of between 515. Companies that are indulged in biotechnology related activities and have an approval as Bionexus Status Company from the Biotechnology Coporation Sdn Bhd Malaysia are eligible. Similarly to the company car benefit if you offer free parking at the office inform employees how to manage their allocated space.

Tolled Highways or Bridges. No need to report accounting records.

Exempt Private Company Epc And Its Directors Responsibilities Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretary

Starting An Exempt Private Company In Singapore Benefits And Process Singaporelegaladvice Com

Exempt Private Company Epc And Its Directors Responsibilities Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretary

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

8 Best Bond Funds For Retirement

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

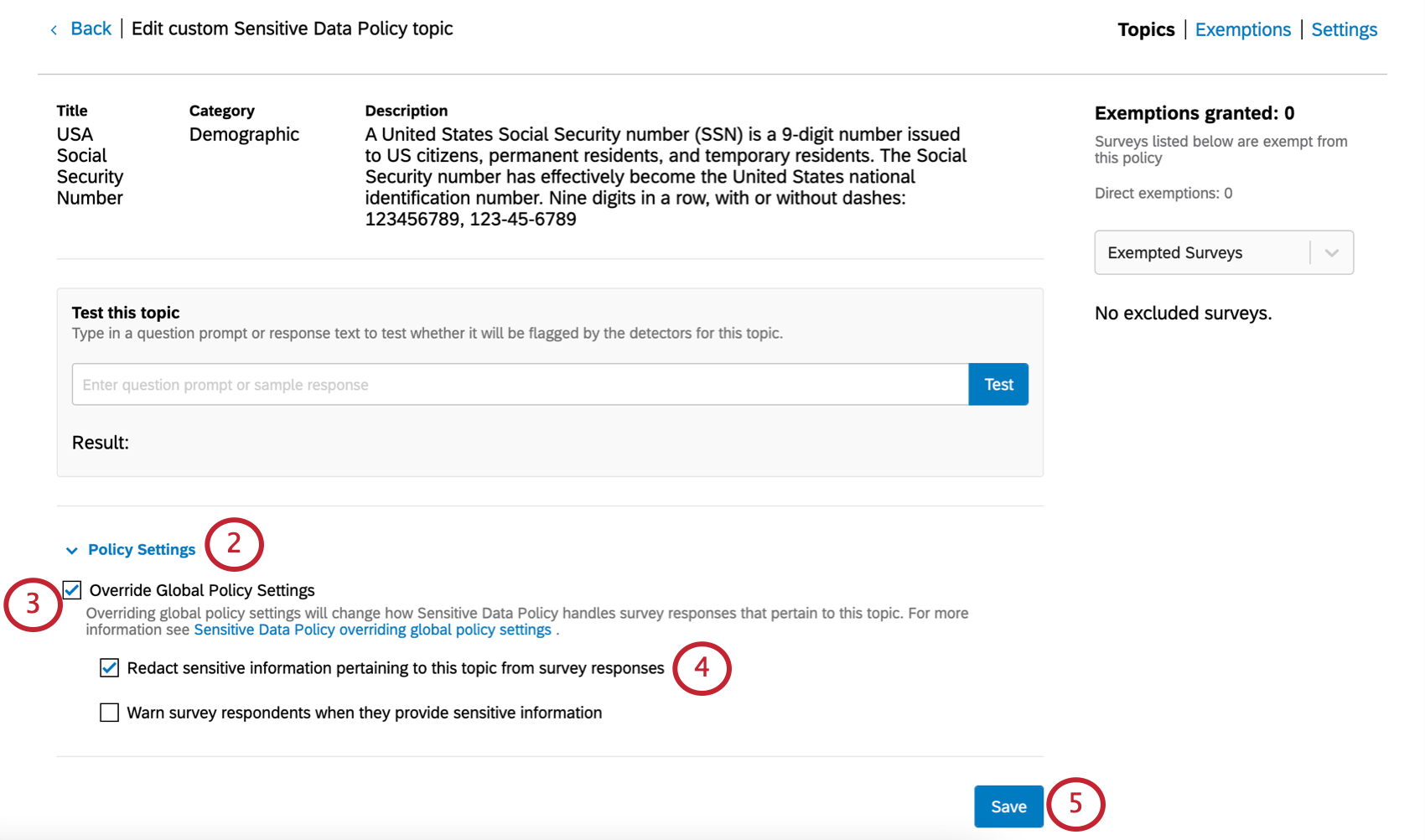

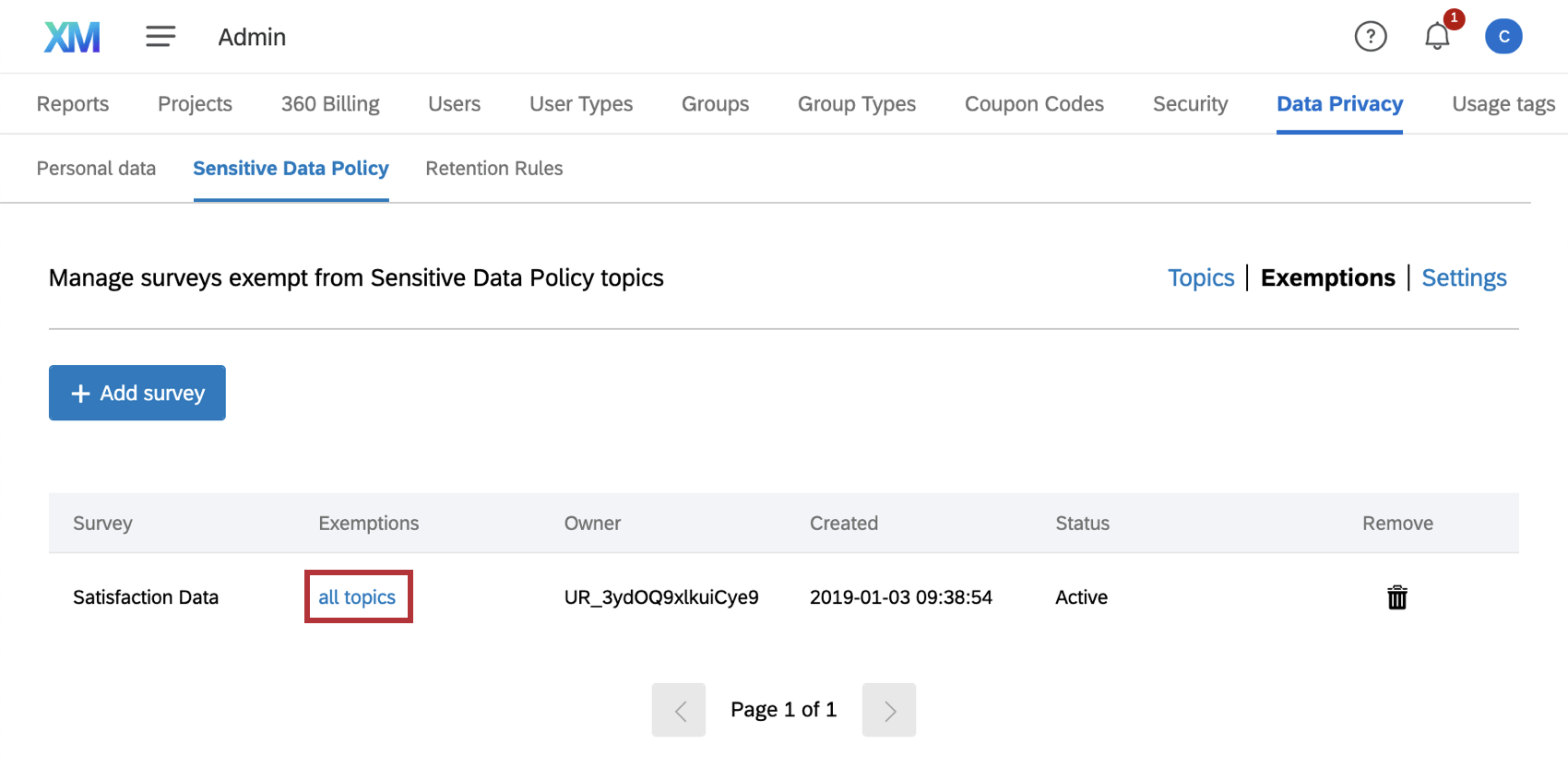

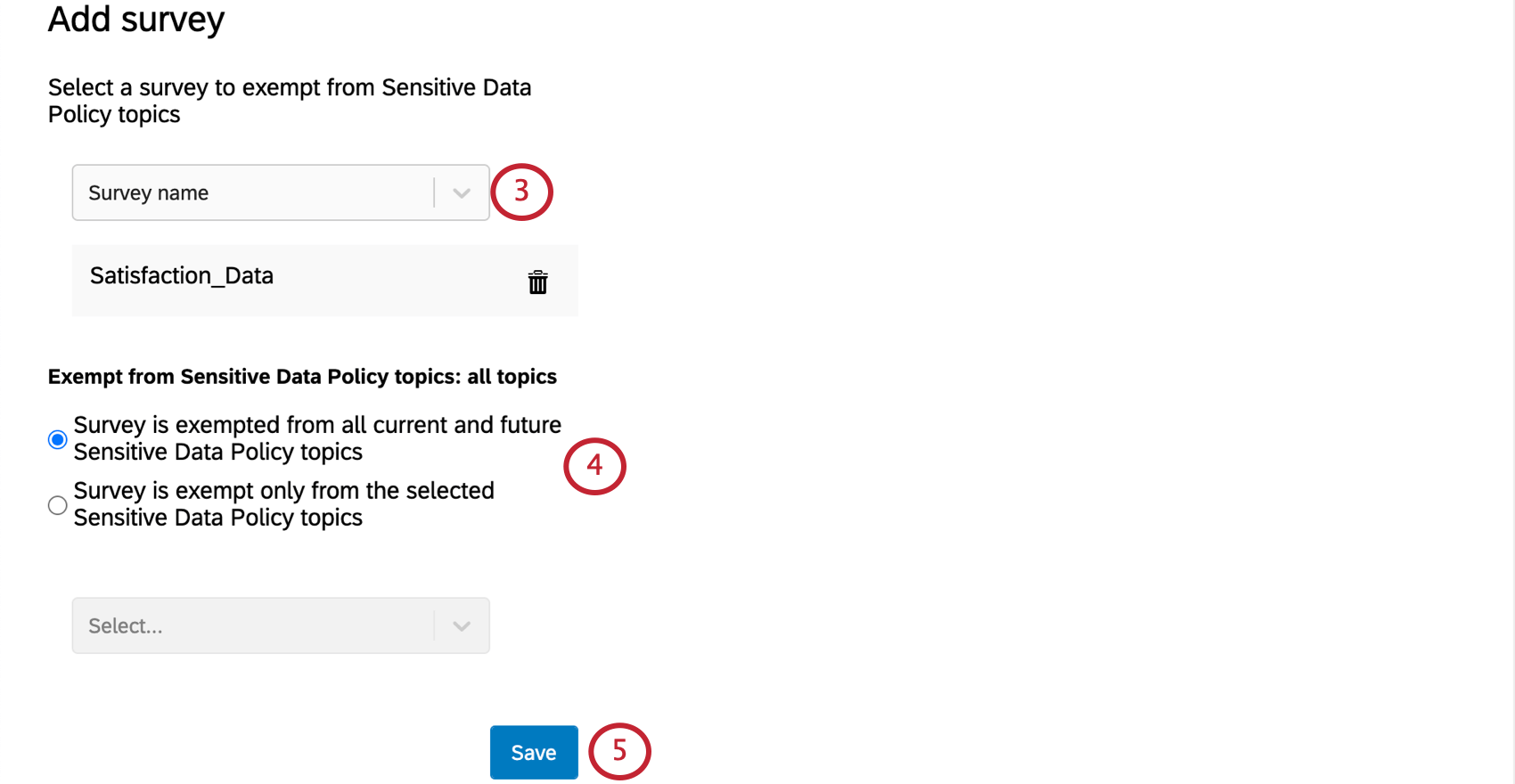

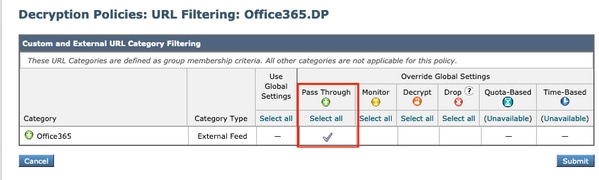

How To Exempt Office 365 Traffic From Authentication And Decryption On Cisco Web Security Appliance Wsa Cisco

The Difference Between A Private Company And An Exempt Private Company

7 Things To Include In Every Employment Offer Letter Innovative Employee Solutions

St Partners Plt Chartered Accountants Malaysia Ssm Effective From 1st February 2019 It Will Be Mandatory For Companies In Perlis Perak Kedah And Penang To Submit Below Documents Via The

Who Is Exempt From Paying Income Taxes Are Some People Really Exempt From Paying Taxes Howstuffworks

Malaysiakini Private Company Sarawak Family